Quick Highlights

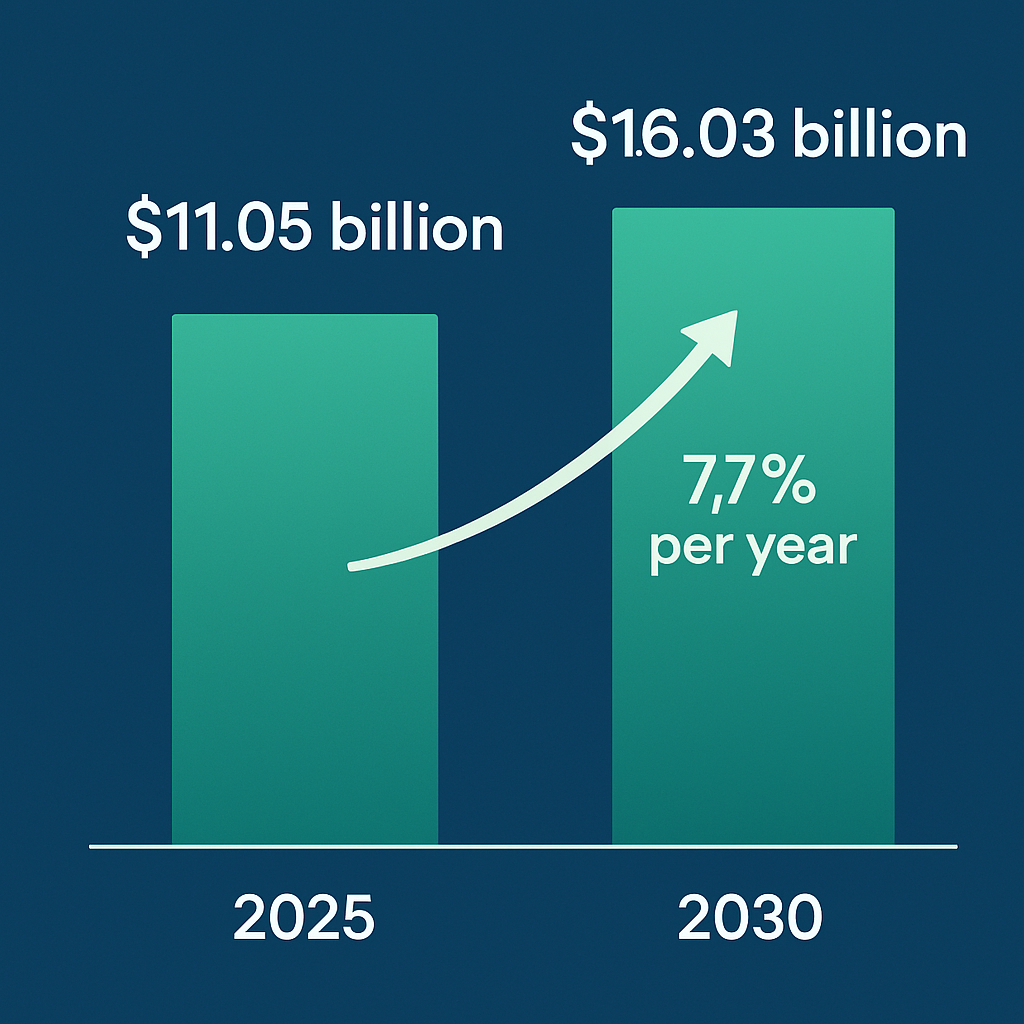

- I’ve dug into some studies, and it looks like the high-frequency trading (HFT) market is sitting at about $11.05 billion in 2025, with folks predicting it’ll climb to $16.03 billion by 2030—pretty steady growth at 7.7% a year, thanks to everyone wanting trades done lightning-fast.

- From what I can tell, HFT seems to juice up market liquidity, but it’s got people arguing over whether it’s fair to smaller investors and if it’s behind wild market swings like that infamous 2010 flash crash.

- After poking around, I’d say the rules around HFT differ depending on where you are—Italy’s got its tiny tax, Germany’s asking for licenses, but there’s nothing big and new popping up for 2025.

What’s the Deal with HFT?

High-frequency trading, or HFT for short, is this crazy fast way of trading where computers zip through tons of trades in the blink of an eye—think milliseconds. It’s mostly the big players like banks and hedge funds doing it, jumping on tiny price gaps to make a buck. This article’s my deep dive into what HFT’s all about in 2025—how big it is, what’s driving it, the good and the bad, and how the rules are holding up.

How Big Is It in 2025?

So, I found out the HFT market’s worth around $11.05 billion this year, 2025. People who crunch numbers say it’s on track to hit $16.03 billion by 2030, growing at a solid 7.7% each year. That’s because everyone’s obsessed with speed—trades need to happen now, not later. There’s this thing called colocation too, where traders park their servers right next to the exchanges to shave off even more time. Some reports I skimmed, like one from Proficient Market Insights, peg it a bit lower at $10.87 billion in 2024, jumping to $17.59 billion by 2031, but either way, it’s clear this market’s not slowing down.

| What’s It Worth? | Numbers |

| Size in 2025 | $11.05 billion |

| Size by 2030 | $16.03 billion |

| Growth Rate (2025-2030) | 7.7% per year |

| Years They Looked At | 2018 – 2023 |

| What’s Coming Up | 2025 – 2030 |

Where It All Started

HFT kicked off when trading floors went digital back in the early 2000s. In the U.S., this thing called Regulation NMS split up the markets, and that’s when HFT really took off. I remember reading about the 2010 flash crash—wild stuff! The Dow Jones tanked 1000 points in like 20 minutes, and a lot of fingers pointed at HFT. It’s been a rollercoaster since then, with companies pouring cash into faster tech to stay ahead.

The Tech Behind It

HFT’s all about speed, right? They’re using these beefy computers and smart algorithms to crunch market data and pull the trigger on trades. I came across mentions of microservices—fancy tech talk for breaking things into smaller, faster pieces—and cloud computing helping out too. Some traders even use AI to figure out their next move. Tools like Python’s Streamlit pop up for number-crunching, handling thousands of data points a day.

How They Play the Game

There’s a few tricks HFT folks use:

- Market-making: They throw out buy and sell orders to keep things flowing, tightening up the gap between what people want to pay and sell for.

- Arbitrage: Spotting price differences between exchanges and jumping on them fast.

- Statistical arbitrage: Using math models to find where prices are off and cashing in.

They lean on limit orders a lot—keeps things under control and stops prices from slipping too much.

Why It’s Great

From what I’ve seen, HFT really helps keep markets liquid. It squeezes those bid-ask spreads down to almost nothing, which is awesome for everyone trading. I read this Canadian study that said when they added fees to HFT, spreads jumped 9% for regular folks and 13% for the big guys—proof it’s doing something good. It also helps prices settle where they should, making markets sharper.

The Downside

But it’s not all rosy. Without humans in the mix, things can go haywire—like that 2010 crash. There’s this “phantom liquidity” thing too, where orders vanish quick and mess with stability. Plus, the big firms with deep pockets get an edge, leaving smaller investors in the dust. Oh, and cyberattacks? They’re a real worry when markets get choppy.

Rules of the Road

The rules for HFT depend on where you’re at. Italy’s got this tiny 0.02% tax on fast order switches, Germany makes firms get licenses, and the UK’s running with MIFID II—testing algorithms, kill-switches, all that jazz. In the U.S., after that 2010 mess, the SEC poked around, but I couldn’t find anything big and new for 2025. Seems like the old rules are still holding the line, though some folks keep talking about a transaction tax that hasn’t landed yet.

How It Shakes Up Markets

HFT pumps in liquidity, no doubt, but it can disappear fast, rattling things. It’s spread beyond stocks to forex, ETFs, even commodities, giving traditional banks a run for their money. Big names like Virtu and Citadel are killing it, while fintech’s opening doors for smaller players. Still, people argue over whether it’s a net win or just stacks the deck against the little guy.

Tools They Use

I stumbled across this cool resource on HFT software—check out Moontrader’s take on it. They’ve got stuff like Moontrader Terminal, built for speed with ready-made algorithms and hooks into exchanges like Binance. It’s got risk controls too, like filters and stop-losses, keeping things tight while crunching live data for crypto trades.

Wrapping It Up

So, here we are in 2025, and HFT’s a big deal—$11.05 billion big, with room to grow. It’s making markets slicker but stirring up trouble too. The rules are all over the place, and nothing huge has changed this year from what I can see. I’ve pulled all this together to give you the full picture—hope it helps make sense of this wild trading world!